LimeX

Global developer of the TV streaming services on Android, iOS, Smart TV, Android TV and Web

Scroll down to

see more

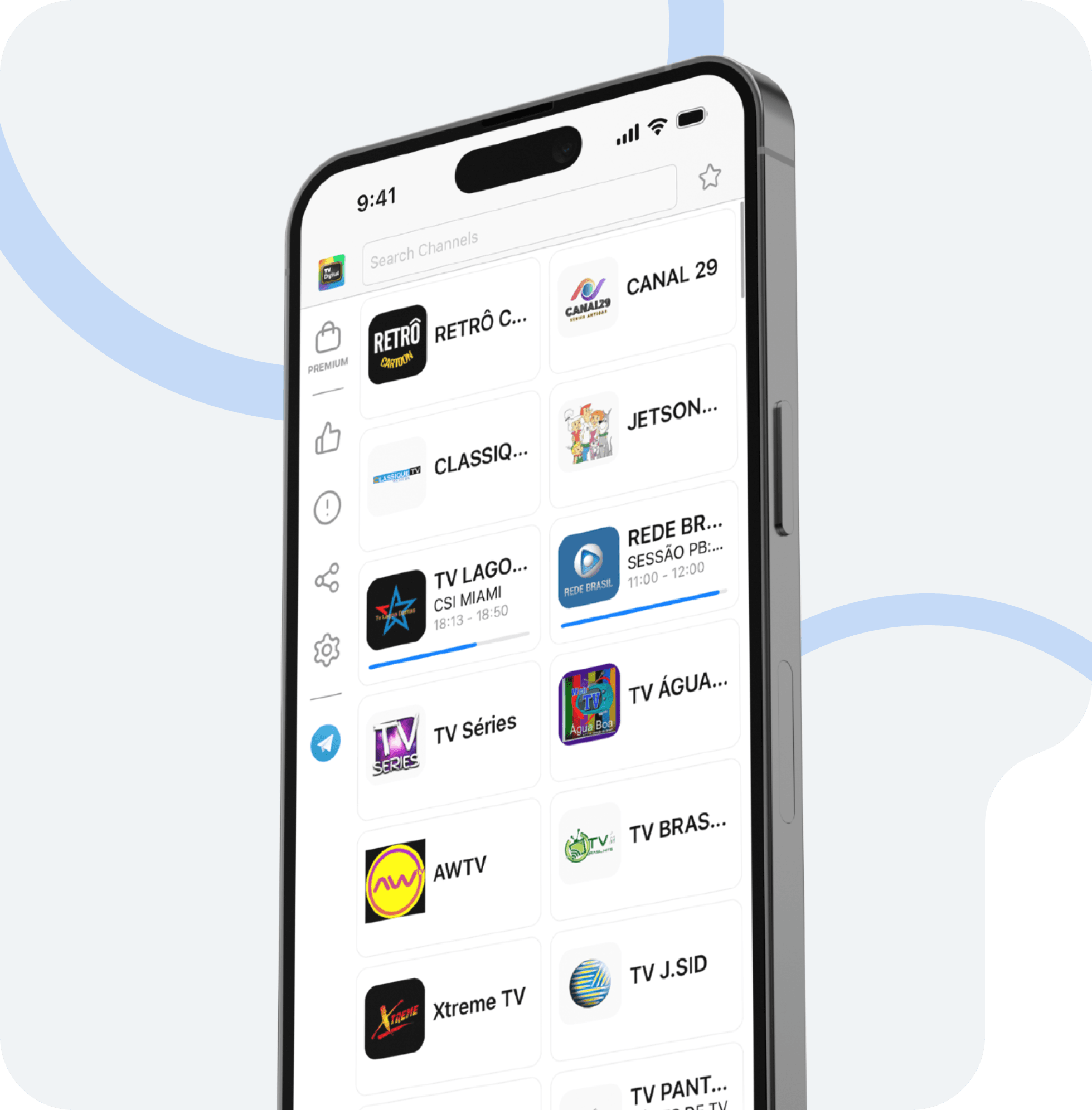

Platforms

- Android TV

- Smart TV

- iOS

- Android

- Web

100M+

Downloads worldwide

Offer your content & monetize

If you are a broadcaster or content owner, place your TV channel or content on our Services and monetize ad inventory with us by revenue share.

For TV Channels

Benefits

🔥 Our services are highly sought-after by users for extensive choice of TV channels and seamless content streaming without the need to register.

🤩 Our services are accessible from a variety of platforms and devices.

Interactive Tools

Our interactive tools allow the viewer to interact with the TV shows by rating and participating in surveys.

While watching a TV program, the viewer notices an interactive window displaying a message on the screen

Upon clicking OK, the viewer is directed to a microsite that requests the viewer’s phone number. After entering the phone number a promo code for a discount is sent to the viewer via SMS.

Targeting

- By the time of the day/program

- By the geolocation

- Socio-demographic targeting

- Based on the broadband access:

- a) online purchases

- b) interior decoration, etc.

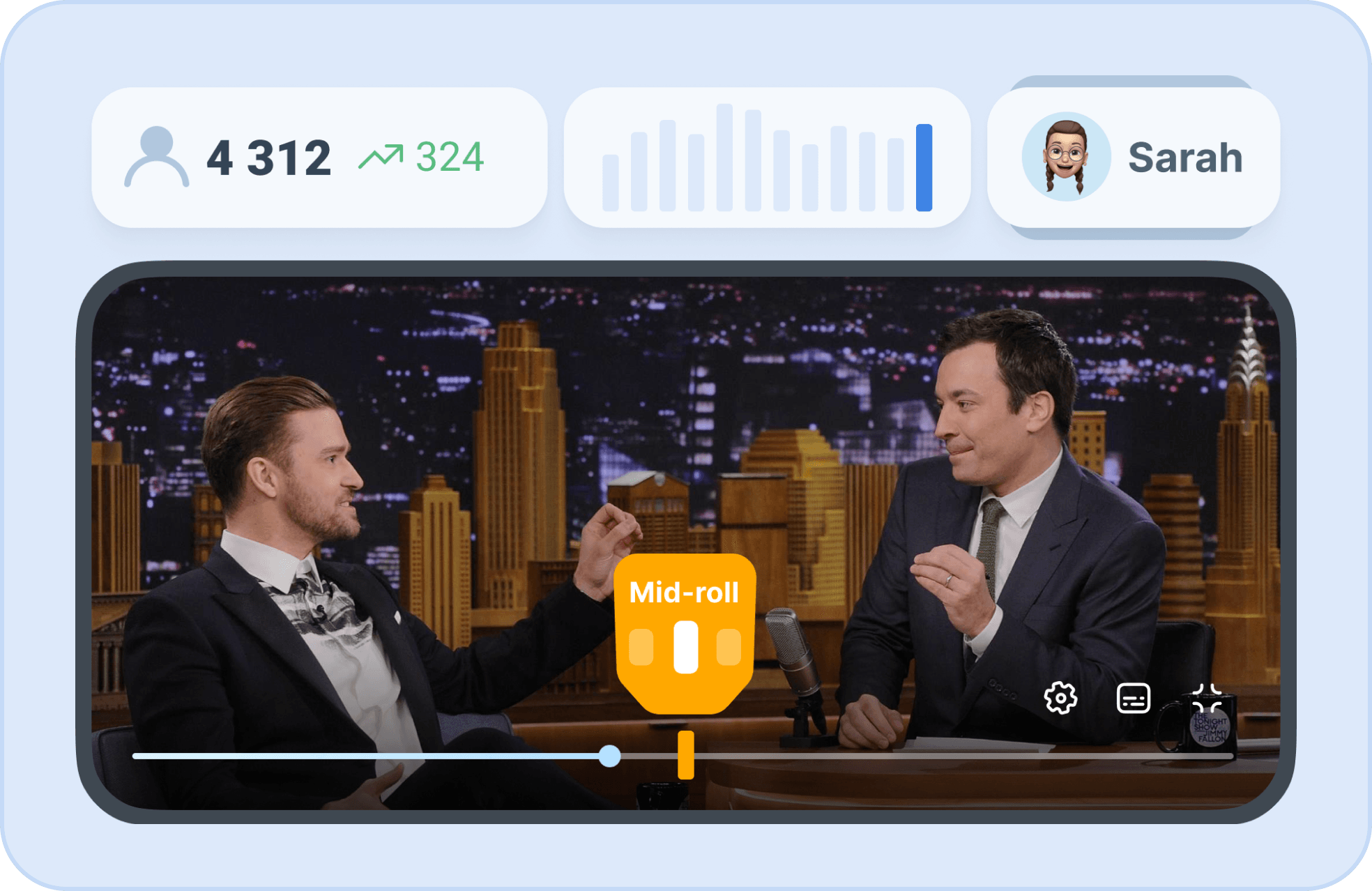

For Advertisers

Advertise directly on our platforms without intermediaries. You pay only when your advertisement is viewed. Also, receive a comprehensive report on your ad campaign`s performance.

Benefits

💪 Select from a wide range of advertising formats

🎥 Diverse ad placement options within the interface/platforms and video streams.

Interested in collaborating with us?

Feel free to get in touch, our dedicated team will guide you and respond to all your queries.